exempt vs non exempt california

Forklift Trucks CVC 4013 A forklift truck which is designed primarily for loading unloading and stacking materials is. Guide to California Law Certain employees are nonexempt under California law.

New York And California Minimum Exempt Salary Obligations In Effect Pr Council

If the user of this worksheet requires legal advice or other professional services the user should contact their Human Resources Professional own legal counsel or other.

. In California the general overtime provisions are that a nonexempt employee 18 years of age or older or any minor employee 16 or 17 years of age who is not required by law to attend school and is not otherwise prohibited by law from engaging in the subject work shall not be employed more than eight hours in any workday or more than 40 hours in any workweek unless he or she receives one and one. Exempt from Orders except Sections 1 2 4 10 and 20. Most employees in a company will be non. California law generally requires the payment of overtime to non-exempt employees for hours worked over 8 in one workday and over 40 in one workweek and on the 7th day of the workweek.

The Fair Labor Standards Act FLSA protects the salary by regulating minimum wage working hours and overtime recompense. An exempt employee is exempt from the civil service law and rules and is not included in the collective bargaining process but they receive benefitsleave credits equivalent to the Collective Bargaining Unit Identifier CBID associated with their position. The exempt license plates unless the vehicle is being transferred to another exempt agency. Payments to employees in these two categories are not.

A non-exempt salary is a set payment that awards employees overtime pay. But some employers pay hourly employees a fixed salary such as 1k per week or 50k per year. Foreign government employees are not subject to UI ETT SDI or PIT withholding. If an employee has a guaranteed minimum amount.

The employee must be paid a salary that is at. They have many rights that exempt employees do not. Nonexempt status Its up to employers to determine whether to classify an employee as exempt or nonexempt under the Fair Labor Standards Act FLSA. The distinction between exempt or non-exempt status can be made by the California Labor Commissioner by examining what work the employee performs.

An exempt employee is not eligible to receive overtime pay and is excluded from minimum wage requirements. The three main factors determining whether an employee receives this type of salary include the type of work the wages and payment method salary or hourly basis. How much they are paid. Determining correct exemption status for California employees is one of the most challenging complicated and risky tasks faced by human resources professionals.

Here are some basic guidelines about exempt. Employees of instrumentalities owned by a foreign government are similarly exempt when there is a formal agreement. EXEMPT Certain employees are exempt from California and federal laws gov - erning minimum wage overtime work hours and rest periods25 As mentioned above there are usually three simple requirements to determine whether a worker is an exempt employee under California law. Generally employees are to be considered non-exempt hourly unless they meet the specific requirements for exempt status.

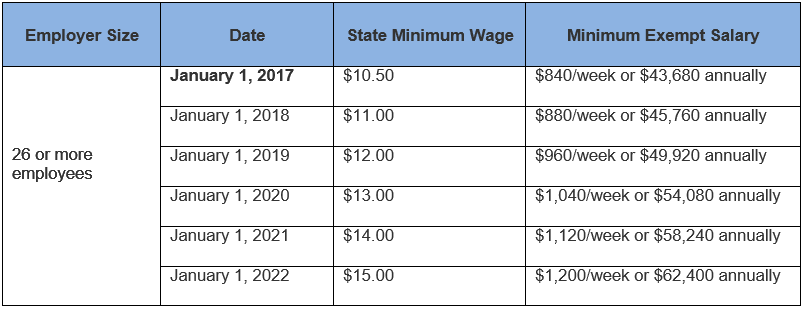

Exempt employees receive compensation based on the service they provide and the results they reap compared to nonexempt employees who are. EXEMPT VS NON-EXEMPT IN CALIFORNIA 2021 PERSPECTIVES. This figure which is valid as of January 1 2021 is double the state minimum wage of 14 an hour multiplied by 52 40-hour workweeks. Essential in determining the status of employees are their compensations and their duties.

Waive fees and penalties due prior to purchase by the exempt agency. The calculation is straightforward for non-exempt employees paid only an hourly wage. How they are paid. Exempt to Fee Paid.

The minimum wage in California is 10hour. Sometimes reclassification is necessary but this too comes with risks. All Orders Section 1. One of the main differences between exempt employees and non-exempt employees is that exempt employees receive a salary for the work they perform while non-exempt employees earn an hourly wage.

Exempt workers arent eligible for overtime pay. Any individual who is the parent spouse child or legally adopted child of the employer. California sets a minimum salary for jobs to be classified as exempt. An Authorized Emergency Vehicle permit issued by the California Highway Patrol CHP must be obtained if Code 3 equipment red light and siren is installed on a privately-owned firefighting vehicle.

Whether an employee is exempt or non-exempt generally depends on. Non-exempt employees Free Consultation Federal law requires that certain employees non-exempt employees be paid overtime wages and other benefits while others are exempt from these requirements because of their specific job duties. Non-exempt employees are protected by wage and hour laws. For an exempt employee the legal demand is to earn a monthly.

Before reclassifying employees employers should explain the law to them and stress that they didnt do. For example a non-exempt employee who is reclassified as exempt may resent no longer receiving overtime wages while an exempt employee who is reclassified as non-exempt may perceive the change as a reduction in prestige. Collect full-year fees and use tax if due. California - Executive Exemption Worksheet The information provided in these documents is informational only and is not intended to substitute for legal or other professional advice where the facts and circumstances warrant.

All Orders by operation of law see Labor Code Section 1171 Outside Salespersons. An excluded employee is excluded from collective bargaining the Dills Act. Collect fees for duplicates and use tax if due. California and military personnel who are California residents stationed in California.

Exempt employees are ones to whom important California wage and hour laws do not apply. Jobs in California that pay less than 58240 a year are generally classed as nonexempt. Employees paid less than 23600 dollars a year or 455 dollars a week are considered non-exempt. Whether employees are intentionally or mistakenly misclassified employers may owe misclassified employees back-wages and other penalties under the California labor code.

Unfortunately employers sometimes misclassify employees as exempt to avoid paying those workers the California overtime rate and other benefits entitled to non-exempt employees.

Time Off Requests For Exempt Vs Non Exempt Workology

Labor Laws You Should Know In 5 Minutes Or Less Infographic Labor Law Employment Law Educational Infographic

Learn The Difference Between Exempt And Non Exempt Employees Guidelines For Both Types Of Jobs And Information Executive Jobs Human Resources Humor Job Help

What Is An Exempt Employee Requirements Qualifications And More

Exempt Vs Non Exempt In California 2021 Perspectives Employers Group

Exempt Vs Non Exempt Employee Definitions Differences How To Determine

Posting Komentar untuk "exempt vs non exempt california"